What is workers’ compensation insurance?

Workers’ compensation insurance

Workers’ compensation insurance covers medical costs and lost wages for work-related injuries and illnesses. This policy is required in almost every state for businesses that have employees.

Does your small business need workers’ compensation insurance?

For almost all businesses in the United States, yes. Workers’ compensation insurance usually isn’t optional.

While workers’ comp laws vary by state,

small businesses typically need a policy in place as soon as they hire their first employee.

small businesses typically need a policy in place as soon as they hire their first employee.

Even when not required by law, this policy provides important protection against medical expenses and employee lawsuits related to workplace injuries.

You can rely on workers’ comp if an employee needs medical care or time off due to a workplace injury – or if an injured employee sues you for failing to prevent an accident.

If you don’t carry workers’ comp, your business will be responsible for any medical bills and legal fees. And most states levy costly penalties for noncompliance.

Why is workers’ compensation coverage important?

A serious workplace injury could financially devastate your business. Many small businesses can’t afford to pay medical bills out of pocket, whether it’s treatment for carpal tunnel syndrome or a broken leg.

Without workers’ comp coverage, both you and your employees are left in a difficult situation.

Does workers’ compensation protect against employee lawsuits?

In many states, yes. Most workers’ compensation policies include employer’s liability insurance to protect your business if an injured worker files a lawsuit against you for not preventing a workplace accident.

If an employee sues for negligence, your insurance company will pay for:

- Attorney’s fees

- Court costs

- Settlements or judgments

Business owners in North Dakota, Ohio, Washington, and Wyoming do not have employer’s liability insurance included in workers’ comp.

In these states, workers’ comp policies are purchased from monopolistic state funds, which do not offer this coverage. Insurance companies sell stop gap coverage to protect you from employee lawsuits.

Does workers’ compensation help cover fatal accidents?

Yes, most workers’ compensation policies include death benefits. These help a deceased employee’s loved ones pay funeral and burial costs after a fatal workplace accident.

Workers’ comp can also provide financial assistance for the deceased employee’s family.

Does workers’ compensation cover employees who contract COVID-19?

It typically depends on where an employee contracted COVID-19 (the coronavirus).

Workers’ comp insurance protects employees from on-the-job injuries and illnesses. If an employee contracts the coronavirus while working, then this policy should provide coverage.

For example, a nurse caring for sick patients or a grocery store worker who deals directly with the public would both have a stronger claim than an office worker. Workers’ comp doesn’t cover diseases unrelated to employment.

Your state’s laws could potentially help cover costs related to COVID-19. If you think you might be eligible for a claim, contact your insurance agency’s claims department.

How much does workers’ compensation insurance cost?

Your cost is based on a number of factors, including:

- Payroll

- Location

- Number of employees

- Industry and risk factors

- Coverage limits

- Claims history

Workers’ compensation insurance costs a median of $47 per month. 30% of Safe Harbor Insurance’s small business customers pay less than $35 per month for this policy.

Where is workers’ compensation insurance required by law?

Each state has unique laws and penalties for workers’ comp. In most states, workers’ comp is required as soon as a business hires its first employee.

Other states don’t mandate coverage until a business has two, three, four, or more employees. Texas is the lone state where business owners are never required to purchase workers’ comp.

All other states impose penalties for not carrying workers’ compensation. These can range from fines to jail time – or both.

Workers’ compensation laws in your state

Because state laws regulate

workers’ comp, you’ll need to research the laws in your state to

find the requirements for your business or consult with a licensed

Insureon agent.

Each state sets workers’ compensation requirements

Workers’

compensation is regulated on the state level, and each state has its

own requirements and penalties. Texas is the

only state where workers’ compensation insurance is optional for

employers.

Typically, the number of employees determines when a business needs

workers’ compensation insurance. Most often, it’s required

as soon as you hire your first employee.

Workers’ compensation

laws in your state

your state to learn about workers’ comp requirements for

your small business.

Some states have severe

penalties for not carrying workers’ comp insurance

The penalty for

not purchasing workers’ comp insurance when it is required varies by

state. It can result in a fine, jail time, or both.

States with severe penalties include:

California:

In California, it is a criminal offense to not provide workers’

compensation for your employees. It’s punishable by up to a year in

jail and a fine of no less than $10,000 – or both. Illegally

uninsured employers could face a penalty of up to $100,000.

Illinois:

An employer who did not provide workers’ comp when it was required

must pay $500 for each day of noncompliance, with a minimum fine of

$10,000.

New York:

Illegally uninsured employers could be charged with a misdemeanor or

a felony. Fines range from $1,000 to $50,000, in addition to a

penalty of $2,000 for every 10 days without coverage.

Pennsylvania:

In Pennsylvania, intentional noncompliance is a felony of the third

degree. It can result in a fine of $15,000 and up to seven years in

jail.

In some states, you must purchase workers’ compensation

insurance from a state fund

Some states have workers’

compensation state funds. Businesses in the following states

must purchase workers’ compensation from the state fund, which in

this case is called a monopolistic state fund:

Workers’ compensation purchased from a monopolistic state fund does

not include employer’s

liability insurance. Typically included in workers’ comp,

this insurance protects against lawsuits claiming a worker was

injured by an employer’s negligence. Businesses can purchase stop gap coverage

to close this gap in coverage.

Do self-employed business owners need workers’ compensation insurance?

Typically not by law. States generally require businesses with employees to purchase workers’ compensation insurance.

But sole proprietors, independent contractors, and other self-employed business owners may buy this policy to fulfill the terms of a contract or to protect their income.

Most health insurance policies exclude coverage for work-related injuries and illnesses. If you carry workers’ comp as an independent contractor, your medical bills will be covered when you’re injured on the job.

Workers’ comp can also partially replace wages lost while taking time off to recover from a work-related injury.

Why do certain clients require you to carry workers’ comp?

Your clients don’t want to deal with the expense and hassle of a workplace injury. That’s why they might require contractors who work for them to carry their own business insurance, including workers’ comp.

This requirement limits legal liability for the client. Independent contractors with business insurance are more likely to seek payment from their insurance companies (instead of the client) if they are injured while working on a project.

What does workers’ compensation insurance cover?

Workers’ compensation helps cover costs related to work injuries. Coverage includes everything from ambulance rides to medication and physical therapy.

Workers’ compensation provides coverage for:

- Medical expenses

- Missed wages during recovery

- Compensation for fatal injuries

- Lawsuits related to work injuries

Medical expenses

When an accident happens at a workplace, workers’ compensation covers the cost of immediate care, such as an ambulance ride or an emergency room visit. It also helps pay for surgical procedures, medications, hospital stays, and other medical bills. Ongoing care, such as continuing medication and physical rehabilitation, is also covered.

Example: A painter falls off a ladder while working on a ceiling and breaks a leg. His workers’ compensation policy pays for the ambulance ride to the hospital, surgery, medications, and physical rehabilitation.

Missed wages during recovery

A serious injury can prevent an employee from returning to work for days, weeks, or even months. Workers’ compensation often pays for part of the wages lost while an employee is recovering from a workplace injury or occupational illness.

Example: An HVAC installer accidentally lowers an air-conditioner unit on his foot and breaks several bones. The installer has to stay off his feet for a month, which prevents him from working. The installation company’s workers’ comp policy pays part of the wages that would have been earned during the month of missed work.

Compensation for fatal injuries

When a work-related incident is fatal, workers’ compensation pays death benefits that cover funeral expenses and help support the deceased individual’s family.

Example: An electrician accidentally touches a live wire, goes into cardiac arrest, and dies. The electrical company’s workers’ comp policy covers the cost of the funeral and burial. It also provides financial support to the electrician’s spouse and children.

Lawsuits related to work injuries

Workers’ compensation insurance typically includes employer’s liability insurance. This policy protects the employer from a lawsuit claiming a worker was injured by the employer’s negligence. If an employee sues, it can help pay for:

- Attorney’s fees

- Court costs

- Settlements or judgments

Example: A chef in a restaurant suffers third-degree burns while trying to put out a grease fire. She blames the restaurant for failing to provide a fire extinguisher and adequate safety training. The case goes to court; the restaurant’s workers’ comp policy pays for the cost of hiring a lawyer and the eventual settlement.

Workers’ compensation insurance does not cover:

- Injuries caused by intoxication or drugs

- Injuries claimed after firing or layoff

- Injuries from company policy violations

- Wages for a replacement worker

- Independent contractor injuries

- OSHA fines

State laws determine whether businesses are compensated for losses related to the coronavirus

Healthcare providers and first responders could potentially make a workers’ comp claim if they develop COVID-19 in the course of their work. Workers in other professions might not be covered.

State laws for workers’ compensation vary dramatically, which means your state might help cover the costs when employees contract the coronavirus or are unable to work because of the pandemic. Check with your insurance company’s claims department if you think you might be eligible.

How much does workers’ compensation insurance cost?

Because workers’ compensation insurance is regulated on the state level, the cost of a policy depends on where your employees are located. Companies with more employees and risks pay more for workers’ comp.

The cost of workers’ compensation depends on:

- The state(s) where your employees work

- Your annual payroll

- Your industry

- The type of work done by your employees

- Your claims history

Physically demanding work usually results in higher premiums – so does a history of workplace accidents. The state where your employees work can also influence the cost dramatically.

Workers’ comp is unique in that the cost tends to decrease over time due to overall increases in workplace safety.

How much do small businesses pay for workers’ compensation?

Safe Harbor Insurance customers pay a median premium of $47 per month, or $560 annually, for workers’ compensation. Safe Harbor Insurance typically lists median (midpoint) costs, as averages include extremes like high-risk construction businesses that pay much more for workers’ comp.

The average cost of a workers’ comp claim is $40,000, according to the National Safety Council. A workers’ comp premium is likely a much better deal for your business. That’s why small business owners might purchase it even when it’s not required by law.

30% of Safe Harbor Insurance’s small business customers pay less than $400 per year for workers’ compensation insurance and 39% pay between $400 and $800 per year.

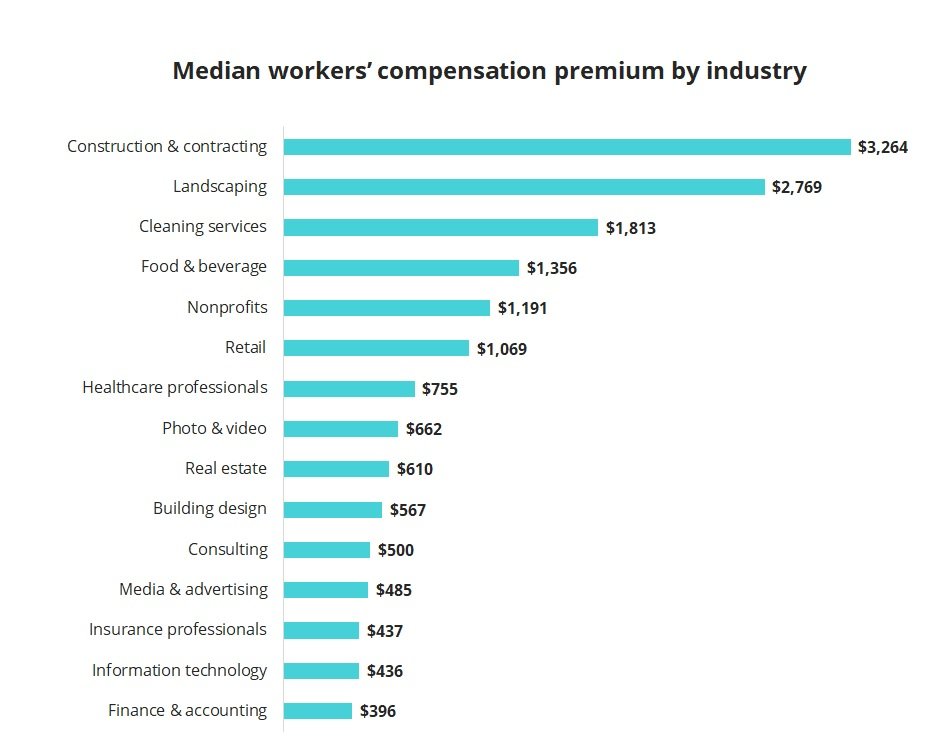

High-risk businesses pay more for workers’ comp

About 20% of worker fatalities in private industry occur in construction. The hazardous nature of that industry results in higher premiums. Likewise, the finance and accounting industry has low premiums due to the minimal risks involved in office work.

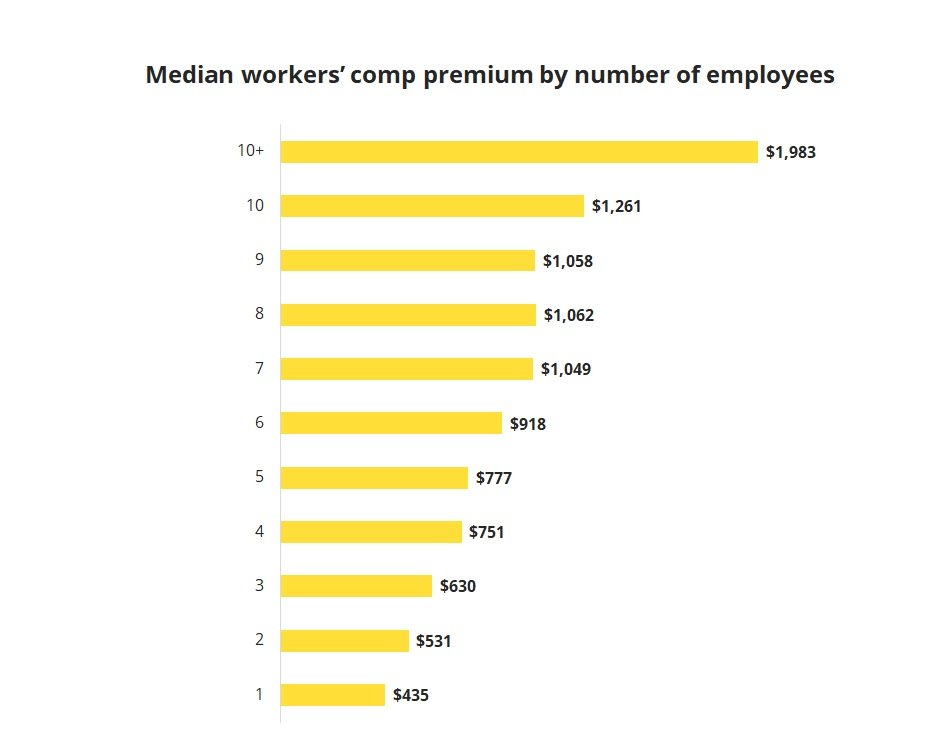

Bigger businesses pay more for workers’ comp

Businesses with more employees pay more for workers’ compensation. There’s a direct correlation between the number of employees at a business and how much the business pays for a workers’ comp premium.

How are workers’ comp premiums calculated?

The amount you pay for workers’ compensation is a specific rate for every $100 of your company’s payroll. Your premium is determined by the type of work done by your employees (classification rate), your experience modification rate (claims history), and your payroll (per $100).

Employer costs for workers’ compensation per $100 of covered payroll range from a low of $0.54 in Texas to $2.27 in Alaska. However, these numbers are deceptively simple. They encompass all types of jobs, which means they don’t reflect the different workers’ comp costs for low-risk versus high-risk work.

The formula is:

Classification rate x Experience modification rate x (Payroll / 100) = Premium

How to buy workers’ compensation insurance

In most states, you can purchase workers’ compensation insurance from a private insurer. With Safe Harbor Insurance, you can compare workers’ compensation quotes from top U.S. carriers. Select your industry and profession in the dropdown below, fill out our easy online application, and we’ll send you quotes that fit your business.

Some states also run their own insurance funds that sell workers’ compensation insurance. And in four states – North Dakota, Ohio, Washington, and Wyoming – businesses are required to buy their workers’ comp policy from the state fund, which in this case is called a monopolistic state fund.

Frequently asked questions about workers’ compensation

We’ve compiled some of the most frequently asked questions about workers’ compensation. Learn how it works, when you need it, and more.

Workers’ compensation insurance requirements and coverages

Each state sets its own regulations for workers’ comp. Most states require it as soon as you hire your first employee. Texas is the only state where it’s optional for employers to purchase workers’ comp.

In addition to differences across states, the construction industry often has separate rules from other industries. Visit our workers’ compensation state laws page to learn about the requirements in your state.

The employer’s liability section of workers’ comp protects the employer from lawsuits related to an injury, such as claims that the employer’s negligence caused the injury.

Your workers’ compensation insurance includes employer’s liability insurance – unless you purchased workers’ comp from a monopolistic state fund. If so, you can add this insurance as an endorsement from a private insurer. Read more about employer’s liability insurance.

How to buy workers’ compensation insurance

Our online application for workers’ compensation insurance takes about 15 minutes to complete. It requires some basic information about your business, including where it’s located, the number of employees, and your estimated annual payroll.

In most cases, we’ll deliver multiple quotes from carriers as soon as you finish the application. Look them over and pick the policy that works best for you. A licensed Safe Harbor Insurance agent is available to assist you throughout the process. Once you purchase a policy, you can access your account and obtain a certificate of insurance, which is a formal proof-of-insurance document.

Safe Harbor Insurance specializes in small business insurance for numerous industries. Our insurance specialists have helped more than 350,000 businesses, including:

- Building design professionals

- Cleaning service businesses

- Construction and contracting businesses

- Consultants

- Finance and accounting professionals

- Food and beverage businesses

- Healthcare professionals

- Information technology businesses

- Insurance professionals

- Landscaping professionals

- Media and advertising companies

- Nonprofits

- Photographers and videographers

- Real estate professionals

- Retail businesses

Workers’ compensation claim and settlement process

When you or one of your employees is injured, you must:

- Give the employee the appropriate paperwork and guidance

- File the claim with the insurer

- Comply with state law for reporting work injuries

To make a workers’ compensation claim, the employee must report the injury within a certain time frame, which varies depending on your state. The employer should provide the employee with appropriate paperwork, including a claims form, and submit it to the insurance carrier.

In some states, incidents must be reported to the state workers’ comp board. The employee may also need to seek medical treatment from a doctor approved by the board. Your agent can guide you through the process and provide answers to any additional questions.