What is professional liability insurance?

Professional liability insurance

Professional liability insurance, also called errors and omissions insurance, protects small businesses against the costs of client lawsuits over unsatisfactory work.

Does your small business need professional liability insurance?

Professional liability insurance is designed for businesses that make a living off their expertise.

Even the most experienced and thorough professional service provider makes mistakes. Unfortunately, clients may not be so understanding if your error costs them considerable time or revenue.

Professional liability insurance helps protect you from unsatisfied clients. For example, if you miss a project deadline, make an omission in your work, or provide ineffective business advice, your client may sue.

If you’re served with this type of lawsuit, your professional liability insurance policy will cover legal defense costs up to your policy limit.

Does professional liability insurance cover losses related to the coronavirus (COVID-19)?

Professional liability insurance protects your business when a client sues over your work performance. That means it might provide coverage when a client sues over a project you were unable to finish or a deadline that you missed due to the coronavirus.

Keep in mind that many business insurance policies exclude communicable disease coverage. If you think you’re eligible for a claim, contact your insurance company’s claims department.

While most of these terms are clear-cut, claims of negligence can be more complicated.

When a client hires you based on your specialized skills, they are entitled to a reasonable standard of care. If your work causes financial damage to a customer, you can be accused of professional negligence.

Professional liability insurance typically covers:

Professional liability insurance typically covers:

- Work mistakes and oversights

- Undelivered services

- Missed deadlines

- Claims of negligence

- Breach of contract

Do some clients require you to carry professional liability insurance coverage?

Yes, clients may request a certificate of insurance as proof that you have coverage. They want peace of mind that if you don’t meet their standards, they can recoup their losses.

Maintaining your professional liability coverage offers you the same assurance.

Many professional liability insurance policies are written on a “claims-made” basis with a retroactive date. This means that in order to collect your insurance benefits, your professional liability policy must be active:

- When an alleged mistake occurs

- When the claim is filed

With a claims-made professional liability policy, your coverage kicks in only when you file a claim during the policy period. Continuous coverage is key if you don’t want to pay out of pocket for lawsuits.

How much does professional liability insurance cost?

Several factors affect professional liability insurance costs, including:

- Industry and risk factors

- Coverage limits and deductible

- Business size

- Day-to-day operations

- Claims history

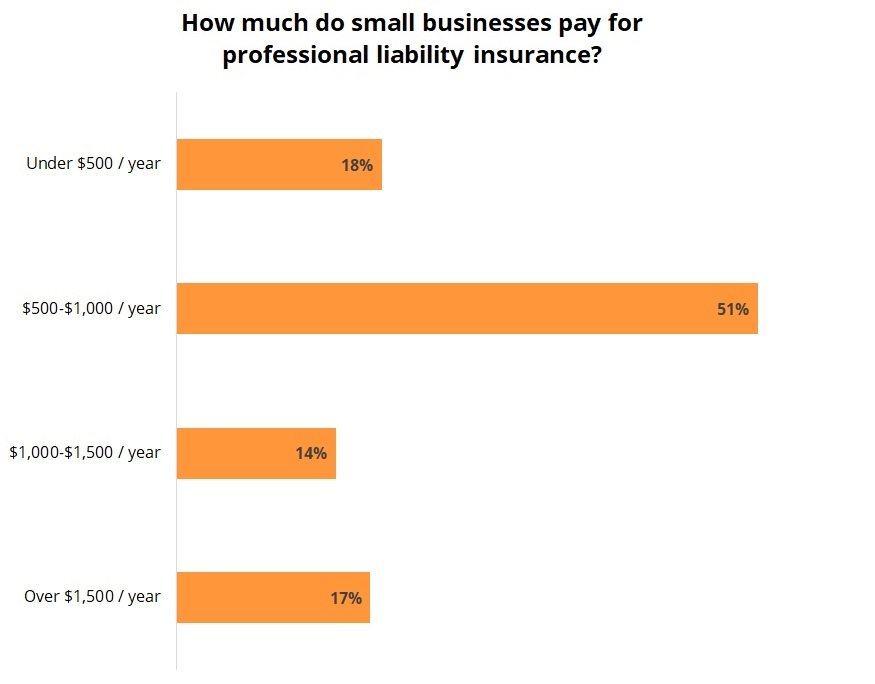

Professional liability insurance costs about $60 per month. Most Safe Harbor Insurance small business customers (51%) pay between $500 and $1,000 per year for their policies.

How does professional liability insurance protect different professionals?

Accountants and auditors

Professional liability insurance for accountants and auditors covers the costs of lawsuits based on accounting errors, data entry errors, miscalculations, or lost documentation. Because the policy offers indirect financial protection for the client, some clients will require proof of insurance before they agree to work with your firm.

Architects

Professional liability insurance protects architects against accusations that a building design does not meet project specifications, was delivered late, or contained errors. A client contract might include a clause that requires this policy’s protection.

Consultants

Professional liability insurance for consultants offers financial compensation for lawsuits alleging ineffective advice or inaccurate projections. Some clients may ask you to provide proof of professional liability insurance before they agree to work with you.

Engineers

Professional liability insurance for engineers covers financial protection from lawsuits over disputes such as cost overrun, delivery delays, and problems with construction materials. You may need to provide proof of professional liability insurance to a client, partner, or licensing board for some projects.

Is there a difference between professional liability and errors and omissions insurance?

The short answer is no. Different industries use different terms for the same type of coverage. You may also see professional liability insurance called errors and omissions (E&O) insurance, even though they’re identical except for the name.

Errors and omissions insurance is used most often for insurance agents, real estate agents, tax preparers, and IT professionals.

Lawyers and doctors refer to this policy as legal or medical malpractice insurance. (While Safe Harbor Insurance doesn’t offer quotes for malpractice insurance, our licensed agents are happy to provide doctors and lawyers the other critical insurance they need.)

How does professional liability insurance differ from general liability insurance?

General liability and professional liability insurance both protect against common small business liability claims, but they cover different types of lawsuits.

General liability insurance covers customer bodily injuries, customer property damage, and advertising injuries. In contrast, professional liability insurance covers any legal defense costs when a client or customer suffers a financial loss due to your professional services or advice.

How do I get a professional liability insurance certificate?

Complete our easy online insurance application to get free quotes. Safe Harbor Insurance’s expert insurance agents can help you choose the best professional liability coverage that meets the needs of your small business. You’ll typically be able to get coverage quickly and receive a copy of your professional liability insurance certificate on the same day.

What does professional liability insurance cover?

When a dissatisfied client sues over a mistake made by your business, professional liability insurance can cover the cost of legal defense, including the cost of hiring a lawyer.

Professional liability insurance provides coverage for:

Work mistakes and oversights

Undelivered services

Accusations of negligence

Missed deadlines

Work mistakes and oversights

Sometimes a simple mistake can cause one of your clients to lose money. When a client sues over an error made by your business, professional liability insurance can help pay for your legal defense costs and more.

Example: An accountant incorrectly enters a company’s financial transactions into a spreadsheet, which leads to inaccurate budget projections. When the budget falls short, the company traces the mistake to the accountant and files a lawsuit. The accountant’s professional liability policy covers the cost of hiring a lawsuit and the eventual settlement.

Undelivered services

If your business promises to provide a service and fails to deliver, a client could sue – especially if it negatively impacts the client’s bottom line.

Example: A management consultant promises a company that it will improve its profits by 20% by a certain date. When the date arrives, profits have gone up, but not as much as projected. The company sues the consultant over its financial troubles. Professional liability insurance helps cover the consultant’s legal defense costs.

Accusations of negligence

If your business is accused of negligence, such as failing to meet industry standards, then it could face a professional liability lawsuit.

Example: An architect designs a building for a client, but the blueprint fails to meet the project’s specifications. The client files a lawsuit, accusing the architect of negligence. The architect’s professional liability insurance covers the cost of the eventual settlement.

Missed deadlines

If a professional misses a deadline, it can have tremendous repercussions for a client. Professional liability insurance provides protection when a client sues over late work.

Example: A tax preparer misses a filing deadline for a client’s tax return and the IRS fines the client. The client sues the tax preparer to recoup the cost of the fine. The tax preparer’s professional liability insurance pays for the cost of hiring a lawyer and the amount that the court rules he must pay the client.

Professional liability insurance does not cover:

- Customer injuries or property damage

- Employee injuries

- Damage to business property

- Employee discrimination lawsuits

- Vehicles used by a business

- Contingent bodily injury

Customer injuries or property damage

If a customer is injured on your premises or you accidentally damage a customer’s property, general liability insurance can help pay for medical expenses or the cost of repairing or replacing the damaged item. It can also cover legal expenses if the customer sues.

Example: A client trips on the front step of your insurance agency and breaks her arm. Your general liability policy can cover the cost of her medical expenses, including physical therapy and medications. If the customer refuses your assistance and opts to sue, your policy can help cover the cost of hiring a lawyer and other legal expenses.

Employee injuries

Workers’ compensation insurance is the policy that covers medical expenses and partial lost wages for employees with work-related injuries or illnesses.

Example: A janitor at your cleaning company suffers a back injury from lifting a floor polisher into a van. Workers’ comp can help cover the cost of his doctor’s visit, physical therapy, and partial wages for his days off during recovery.

Damage to business property

The property coverage included in a business owner’s policy (BOP) can pay for items that are damaged, destroyed, stolen, or lost.

Example: A fire at a medical office destroys part of a building along with the company’s computers and furnishings. The property insurance included in a business owner’s policy could pay for the cost of renovating the building and replacing the ruined items.

Employee discrimination lawsuits

Employment practices liability insurance (EPLI) can cover lawsuit expenses related to claims of harassment, discrimination, and wrongful termination.

Example: An employee at an advertising agency notices that most of the high-end clients are assigned to male workers at the agency. She sues her employer for sexual discrimination; EPLI helps cover the advertising agency’s legal costs and eventual settlement.

Vehicles used by a business

Business-owned vehicles must be covered by commercial auto insurance. Personal or leased vehicles used by a business should be covered by hired and non-owned auto insurance.

Example: A management consultant driving to meet a client in his personal vehicle gets into an accident. His personal auto insurance excludes business use, but luckily he purchased a hired and non-owned policy that covers the damage his vehicle caused.

Contingent bodily injury

Product liability insurance can pay for contingent bodily injuries – which are client or customer injuries that can be indirectly linked to your professional service.

Example: A consultant draws up a list of safety procedures and practices for a client. The client sues the consultant after an employee is injured in a routine safety training.

Professional liability exclusions

Professional liability insurance has other coverage exclusions as well. For example, it doesn’t pay for lawsuits that allege client discrimination or abuse.

It also only covers the cost of defending against lawsuits – it doesn’t pay for lawsuits you initiate. For example, this policy won’t cover your legal costs if you sue a client who refuses to pay you.

Unless your policy has prior acts coverage, it only covers claims filed while the policy is active and for incidents that occurred after you bought the policy.

Endorsements can fill gaps in your professional liability coverage. To make sure you have the coverage you need, contact an Safe Harbor Insurance agent.

How much does professional liability insurance cost?

Professional liability insurance protects your small business from the financial risks of professional mistakes. Your industry and the scope of your services affect the cost of this policy.

Average professional liability insurance costs for Safe Harbor Insurance customers

Regardless of policy limits, the median cost of professional liability insurance is $59 per month ($713 annually). The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

Most small business owners (51%) pay between $500 and $1,000 per year for their policies, and 18% pay less than $500. These figures were derived from an analysis of thousands of insurance policies purchased by Safe Harbor Insurance small business customers.

Industry risks impact professional liability insurance costs

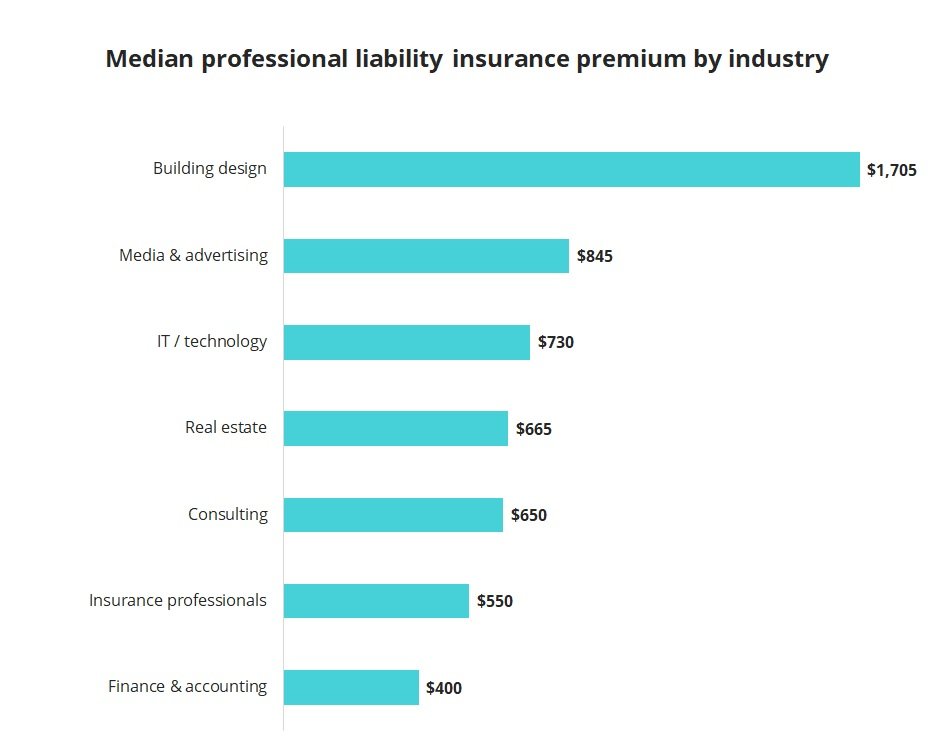

The industry you work in has a significant impact on the cost of professional liability insurance, since different professionals are exposed to different liabilities. In general, high-risk industries pay higher premiums, while low-risk industries enjoy lower rates.

A building design business, for example, usually pays higher premiums than an accounting business because a construction mistake is typically more expensive and more dangerous than an accounting error. Those working in media and advertising also pay high premiums, since advertising injury can have an impact on a client’s bottom line.

How coverage limits affect insurance costs

If you want a professional liability policy that pays out more per incident or per year, you’ll need to purchase a more robust policy with a higher premium. The claim limit on common professional liability policies varies significantly, from $250,000 to $2 million. However, most Safe Harbor Insurance customers (61%) purchase a $1 million / $1 million professional liability policy. This includes:

$1 million occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim.

$1 million aggregate limit. During the lifetime of the policy (usually one year), the insurer will pay up to $1 million to cover all claims.

Tips for saving money on professional liability insurance

Pay your entire premium upfront. You can choose to pay your insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run since insurers often offer discounts to businesses that pay an annual premium.

Keep continuous coverage. While it’s possible to purchase professional liability coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire. To collect insurance benefits, your “claims-made” professional liability policy must be active:

- When an alleged mistake occurs

- When the claim is filed

Continuous coverage is key if you don’t want to pay out of pocket for professional liability lawsuits.

Frequently asked questions about professional liability insurance

Professional liability insurance covers the costs of legal disputes over professional mistakes. Learn more about coverage, costs, and other considerations

Professional liability insurance coverage

The circumstances that lead to potential professional liability claims are common in some industries:

- If a client has unmet expectations based on a miscommunication or an error in a contract, email, or order form, they may sue.

- If you give erroneous instructions or advice that causes financial losses a client may blame you and sue for damages.

- If your work is late, incomplete, or fails to meet industry standards, your business could face a lawsuit.

- You’ll have to pay a lawyer $150 to $400 per hour for the time they spend on your case.

- Your legal team will charge you for administrative costs such as copying, data processing, shipping, and travel expenses.

- For certain filings and hearings, you’ll have to cover court costs.

- You might have to pay expert witnesses thousands of dollars to explain a technical aspect of your argument.

- You might have to pay a settlement to avoid trial or a court-ordered judgment if you lose at trial.

How to buy professional liability insurance with Safe Harbor Insurance

Most small business owners purchase a professional liability insurance policy early and maintain the same policy for the life of their business, so there are no gaps in coverage. If you think your business might be exposed, or have let a prior policy lapse, bring it up with your insurance agent. There may be ways to extend your protection.

Professional liability insurance policy changes and claims

Also, canceling a professional liability policy leaves your business exposed to risk. Because it’s a “claims-made” policy, it only provides coverage if the incident and the lawsuit happen while the policy is active. In some cases, years can pass before a client decides to sue over an incident. It’s important to keep your policy active to ensure you’re protected against clients who sue at a later date. Most small business owners keep their professional liability policy in place for the life of their business to prevent gaps in coverage.